Online Banking Help

Securities Trading

Shanghai - Hong Kong Stock Connect /

Shenzhen - Hong Kong Stock Connect

Securities Margin Trading

RMB Denominated Stock Trading

Closing Auction Session

Volatility Control Mechanism

Securities Trading

After enrolling in the Online Securities Trading Services, can I still place order through other channel(s)?

You can still place order through Securities Trading Hotline at 2903 8488 or Mobile Banking.

| Top |

What are the benefits of using Online Securities Trading Services?

With China Construction Bank (Asia) Online Securities Trading Services, you can:

- enjoy preferential brokerage commission rate

- access to real time stock quotes and real time streaming price chart

- view personalized latest market news and research reports

- check your order status, transaction history and portfolio

- set up your own watch list

- receive order confirmation and stock price eAlerts via email/SMS

- place your order easily anytime, anywhere with your PC

| Top |

How can I trade through Online Banking?

You have to be a China Construction Bank (Asia) Online Banking customer with a Securities Trading account.

| Top |

How do I place an order?

On the Trading page:

- Select market

- choose order type

- choose your Securities Trading account

- select buy/sell

- enter stock code, price and quantity

- choose expiry date

You also have the opportunity to view stock quotes and broker queue right before you place order.

| Top |

Does the Bank accept price orders that are different from current market prices?

Yes, but if the order with input price deviate 20 spreads or more than the current market price will be kept in our system. The order will only be sent out to market for queue until the spread deviation are less than 20 spreads.

| Top |

How do I know the Bank has received my order?

After the Bank received your order, you will receive an order reference number. You can also check your order status in the "Order Status" section.

| Top |

How can I check the status of my order?

You can go to the "Order Status" or "Order History" section to check the status of your order. You are allowed to cancel the instruction while the status is ”Queued”, ”Received” or ”Partially Executed”. You can also go to the "Order History" section to check the final status of your order.

| Top |

Can I amend or cancel my order?

Yes. You can amend or cancel your Enhanced Limit Order, Special Limit Order and Limit Order when the order status is "Queued", "Received" or "Partially Executed". The order status will be shown in the "Order Status" section. For Stop Loss Order, you can cancel the order only. For Market Order, no amendment or cancellation is allowed.

| Top |

How am I notified of the execution results?

You will be notified of the respective execution results via email and/or SMS if you have registered for our Stock Order Confirmation eAlert service, the notice will be sent to the email address you have provided in "Maintain My Details"; and the SMS notice will be sent to the mobile phone number you have provided via branch. Stock Order Confirmation eAlert service may . Stock Order Confirmation eAlert service may be out of order or delayed due to unpredictable network traffic congestion and other reasons. You can also check your order status in "Order Status / History " section. You can click here to understand the risk of Stock Order Confirmation eAlert service.

| Top |

How can I keep track of the stock?

The Stock Watch function allows you to input the stocks you are interested in and will show information such as nominal, change, volume and P/E ratio for each stock you selected. Price alert function enables you to input the target price of your selected stocks in order to provide the updated information for your investment decision. This service only available if you have registered for our Stock Order Confirmation eAlert service and provided your email address and/or mobile phone number in "Maintain My Details".

| Top |

What is "All-or-Nothing"?

All-or-Nothing binds your order to be either executed in full or rejected. The default setting in our Online Banking is “No” and cannot be changed.

| Top |

What is "Limit Order"?

Limit Order allows your order matching only at the input price. The unfilled Limit Order will be put in the price queue of the input price. Regardless of the final execution result (the order is partially executed or unexecuted), any unfilled Limit Order will lapse and be cancelled at the end of that trading day (except Good-till-date instruction).

| Top |

What is "Enhanced Limit Order"?

Enhanced Limit Order allows your order matching up to maximum 10 price queues at a time provided that the traded price is not worse than the input price. The unfilled Enhanced Limit Order will be converted to Limit Order and put in the price queue of input price. The default setting in our Online / Mobile Banking is "Enhanced Limit Order". Regardless of the final execution result (the order is partially executed or unexecuted), any unfilled Enhanced Limit Order will lapse and be cancelled at the end of that trading day (except Good-till-date instruction).

| Top |

What is "Special Limit Order"?

Special Limit Order allows your order matching up to maximum 10 price queues at a time provided that the traded price is not worse than the input price. A Special Limit Order has no restriction on the input price as long as the order input price is at or below the best bid price for a sell order or at or above the best ask price for a buy order. Any unfilled Special Limit Order will be cancelled by the market immediately after matching.

| Top |

What is "At auction Limit Order"?

At-auction Limit Order is a limit order with a specified price of which input is allowed only during Pre-opening session. The Bank only accept the At-auction Limit Order with input price does not deviate 200 spreads or 9 times from the prevailing nominal price or previous closing price (whichever is lower). The unfilled At-auction Limit Orders in pre-opening session will be converted to Limit Order at the input limit price and carried forward to the continuous trading session.

| Top |

What is "Stop Loss Order"?

A Stop Loss Order can only be given to the Bank during Continuous Trading Session on a trading day.

The Stop Loss Price and the Lowest Selling Price could only be specified within the price ranges determined by the Bank.

A Stop Loss Order will only be triggered if the nominal price of the relevant stock is equal to or lower than the specified Stop Loss Price during trading hour on the relevant trading day. Please be reminded that the Stop Loss Order may be fully executed, partially executed or unexecuted by one time at a price not lower than the Lowest Selling Price on the relevant trading day. Market conditions may make it impossible to execute your Stop Loss Order.

Regardless of the final execution result (the order is partially executed or unexecuted), any unfilled Stop Loss Order will lapse and be cancelled at the end of that trading day.

The Stop Loss order may be rejected by market due to market fluctuation.

| Top |

What is Stop Loss Price?

It is the selling price of a stock specified by you and must be set below the nominal price. Stop Loss Order will be triggered and placed to the market once Stop Loss Price is reached.

| Top |

What is Lowest Selling Price?

It is the lowest selling price (which must be a price lower than the relevant Stop Loss Price) specified by you to sell your specified stock in the Stop Loss Order.

| Top |

Can I place a multiple-day Stop Loss Order?

No. the Stop Loss Order is only valid for 1 trading day.

| Top |

What is "Market Order"?

Please note that Market Order cannot be amended or cancelled after the order is placed.

A Market Order shall only be given to the Bank during Continuous Trading Session on a trading day.

Market order is an order which you do not set a limit price. Such order will be executed at prevailing market price at time of execution. Please be reminded that the executed price may deviate (mildly, significantly or dramatically) from your expected price due to market fluctuation.

The Bank will submit your Market Order to the market (in a number of tranches) for auto-matching and execution by matching it up to a maximum of 30 spreads from the prevailing nominal price (as the case may be). Any unfilled quantity of your market order will be cancelled immediately. You can also enquire your order status in “Order Status” or “Order History” section.

| Top |

Can I place an order during non-trading hour or non-trading day?

Yes. If the instruction input during non-trading hour or non-trading day will be treated as an instruction given to the Bank on the next relevant trading day. For Northbound Trading, order can only be placed during the trading hours of Shanghai Market.

| Top |

What is "Good-till-date" Instruction?

"Good-till-date" Instruction enables you to place an instruction to buy or sell stock and the instruction will remain valid up to 10 trading days.

| Top |

Which order types can set "Good-till-date" Instruction?

Good-till-date instruction is only available for Enhanced Limit Order and Limit Order.

| Top |

I have placed a "Good Till Date" order. If the order cannot be fully executed on same day and is partially executed on different days, will all the execution results be consolidated for calculating the charges?

No, only the execution results of every order executed on same day will be consolidated for charge calculation otherwise the charge will be calculated separately.

| Top |

Will my order be valid if there is any corporate action of the company?

Due to any corporate action (including but not limited to stock split or consolidation) that will impact your original instruction (including but not limited to the price and quantity), the relevant buy/sell order may be cancelled. If the trading of the relevant stock is suspended during trading hours and the status is unchanged on the next trading day, the relevant Good-till-date instruction will be cancelled. You should keep watching for any corporate action related to your stock for which you have placed order.

| Top |

Can I sell the stocks I have bought before its settlement?

Yes.

| Top |

Can I use the funds from selling a stock to buy a new stock before its settlement?

Yes. However if a sell transaction of Callable Bull Bear Contracts (CBBC) is cancelled by the HKEx due to the mandatory call, the pending receivable trade settlement amount will be deducted after market close on the mandatory call day. Under this situation, if you utilize the pending receivable trade settlement amount for stock purchase, you will be liable and required to deposit sufficient fund for the transaction settlement. For details on the mechanism of CBBC’s mandatory call, you may refer to HKEx’s web site.

| Top |

What is total purchasing power?

For Securities Cash Trading Account, total purchasing power refers to aggregate of the available cash balance and net proceeds of unsettled purchase and sale orders. For Securities Margin Trading Account, available cash balance including available overdraft facilities and net proceeds of unsettled purchase and sale orders and available cash in the secondary settlement account linked to the Securities Margin Trading Account.

| Top |

Will the transaction I perform today be reflected in my ”Portfolio”?

Yes, once your order is executed, the transaction you performed will be reflected in your “Portfolio”. Partially executed orders will be reflected in your “Portfolio” after the market is closed.

| Top |

What is Streaming Quote?

Streaming Quote is a chargeable stock quote service, you must open our Securities Trading account,Online Banking Service and apply for this service at our Branches. For the plan and fee of Streaming Quote, please refer to the latest Schedule of Service Fees for Securities Trading Services.

| Top |

What are Personalized Latest News and Research Reports?

Upon your logon to Online Banking, Personalized Latest News and Research Reports will bring you the related latest market information based on your Portfolio and Watch Lists of the previous day. If you do not have any securities holdings or do not have any stocks maintained in your watch list, general Latest News and Research Reports will be displayed.

You may also subscribe our Latest News and Research Reports eAlert service to receive related market information via email, free of charge.

These services are available for securities trading customers only.

| Top |

If I placed an order via the manned channel and subsequently modified the order on Online Banking or placed an order on Online Banking and subsequently modified the order via manned channel, which channel rate will be used to calculate the commission?

If it involves more than one channel for placement and modification for the same order, the commission will be calculated based on the priority pre-set by the Bank. For the above cases, the manned channel brokerage commission rate will be applied. Please note that the priority is subject to review and change by the Bank from time to time without prior notice.

| Top |

Can I choose to receive eStatement for Securities Trading service?

Yes, please click here for more details about the eStatement Service for Securities Trading Account.

| Top |

Shanghai - Hong Kong Stock Connect /

Shenzhen - Hong Kong Stock Connect

Can investors hold SSE or SZSE securities through Shanghai and Shenzhen Northbound Trading in physical form?

Since SSE and SZSE securities are issued in scripless form, physical form is not available.

| Top |

How do investors obtain the latest company announcement?

All approved corporate actions on SSE and SZSE securities will be announced by the issuers through the SSE and SZSE website and officially appointed newspapers (both the printed paper and their websites: the Shanghai Securities News, Securities Times, China Securities Journal,Securities Daily) and the website www.cninfo.com.cn.

Hong Kong and overseas investors can also visit HKEx website’s China Stock Markets Web for the company announcements of SSE and SZSE securities issued on the previous trading day.

Please note that the corporate announcements will only be provided in Simplified Chinese.

| Top |

Can investors attend the relevant shareholder meetings in person or appoint more than one person to attend and act as proxy at the meetings on his/her behalf?

As HKSCC is the shareholder on record of SSE/SZSE-listed companies (in its capacity as nominee holder for Hong Kong and overseas investors), it can attend shareholders’ meeting as shareholder. Where the articles of association of a listed company do not prohibit the appointment of proxy/multiple proxies by its shareholder, HKSCC will make arrangements to appoint one or more investors as its proxies or representatives to attend shareholders’ meetings when instructed.

| Top |

Can customers cancel their submitted orders within the 5 minutes prior to the opening of each trading session?

Customer can submit their cancellation instruction to the Bank within the 5 minutes prior to the opening of each trading session. However, the instruction is only received by the Bank and will be processed until the market is open for trading. Customers should be aware that the pervious order may be executed before the cancellation instruction is processed.

| Top |

Can I involve in Shanghai and Shenzhen Northbound Trading

For existing securities trading customer in our Bank: Customers can sign up the service and open a RMB settlement account at any of our branches.

For new securities trading customer: Customers can open a securities trading account via any of our branches or Online Banking. Please be reminded that RMB Settlement Account should be set up for the securities trading account in order to be eligible for trading in RMB denominated stock listed on SEHK, SSE and SZSE.

| Top |

Special arrangement on unsettled fund

Due to the difference in cash settlement cycles of SEHK, SSE and SZSE, customer’s purchasing power with the unsettled fund in different markets will be different. Below is the illustration example:

| RMB (“¥”) | Trade Day - 1 | Trade Day | Trade Day + 1 | Trade Day + 2 | |

| RMB denominated securities listed in SEHK | Customer Sell | ¥20,000 | |||

| SSE or SZSE securities | Customer Buy | ¥5,000 | |||

| Cash Balance of RMB settlement Account at the beginning of trading day | ¥10,000 | ¥10,000 | ¥10,000 | ¥25,000 | |

| Held fund for purchased transaction | 0 | 0 | ¥5,000 | 0 | |

| Unsettled fund from the RMB sold transaction | 0 | ¥20,000 | 0 | 0 | |

| Customer's purchasing power in RMB for SEHK | ¥10,000 | ¥30,000 | ¥25,000 | ¥25,000 | |

| Customer's purchasing power RMB for SSE or SZSE | ¥10,000 | ¥10,000# | ¥25,000* | ¥25,000 | |

# Due to the cash settlement date in SEHK is Trade Day + 2

*The unsettled fund used in Northbound Trading on Trade Day + 1:

¥10,000 (cash balance) + ¥20,000 (unsettled fund from the sold transaction which settle in Trade Day + 2) - ¥5,000 (held fund for purchased transaction which settle in Trade Day + 1) = ¥25,000

| Top |

Is there any cut off time for Securities Settlement Instruction on transfer in / out of SSE and SZSE securities?

Yes. The Securities Settlement Instruction should be submitted to the Bank at least 1 business day prior to the expected transfer in / out date stated in the instruction form. The securities settlement instruction can only be handled by the Bank in the condition that both the Bank and counterparty received the completed customer’s transfer in /out instruction.

| Top |

Securities Margin Trading

What is Securities Margin Trading?

With Securities Margin Trading, you only need to pay for a portion of the total cost that you deposit is initial margin. As you have borrowed money from the Bank to buy securities, the securities will be treated as collateral for the Margin facility.

| Top |

How does the leverage work for Securities Margin Trading?

Below please find the illustration example on the leverage work for Securities Margin Trading:

Assume:

Pledge Ratio of Stock A: 60%

No. of share that you are holding: 100

Price of Stock A: HK$100

Your Securities Asset Margin Value (Which indicates the current market value of your portfolio multiplied by their respective Pledge Ratio)

= HK$100 X 100X 60% = HK$6,000

(Fees, levies and other transaction costs are not included in the above example for simplicity. Please note that you still have the full amount of these fees, levies and other transaction costs under Securities Margin Trading arrangement)

| Top |

Can I purchase stocks without utilizing the overdraft in my Securities Margin Trading Account?

Yes. You can continue to pay the purchase considerations in full cash.

| Top |

If I deposit more cash than it is required for my cash margin, can I utilize the unused overdraft for the subsequent purchases in the future?

Yes.

| Top |

How is the mechanism of margin fund transfer in / out?

- The margin account will also be used as the primary settlement account. If there is insufficient fund in the margin account, the cash account as the secondary settlement account will be debited for the fund shortage.

- Any surplus of cash in the margin account (usually after the stocks selling) will not be transferred back to the secondary settlement account (cash account) automatically. You will have to transfer the fund via our function “Margin Fund Transfer”.

What are the ways to withdraw cash from the margin trading account?

- Margin transfer via Online Banking, which operates from 8:00 a.m. to 8:00 p.m. from Monday to Friday (except public holidays);

- Visit our Securities Trading Center from 9:00 a.m. to 5:00 p.m. from Monday to Friday (except public holidays); or

- Call our Securities Service hotline at 2903 8488 from 9:00 a.m. to 6:00 p.m. from Monday to Friday (except public holidays)

| Top |

Will the fund transfer details be displayed in my statement?

Yes.

Will there be automatic funds transfer from settlement account to margin account if there is insufficient fund for my purchase transaction? If so, under what condition will it happen?

Yes, it will happen when there is insufficient fund for initial margin upon buy order (i.e. the sum of margin value of stocks and cash in margin account is less than the purchase amount).

| Top |

Can I open both Securities Cash Trading account and Securities Margin Trading account in same account entity? If so, can I use the same settlement account for both?

Yes, but separate set of settlement accounts are needed. The account open procedure for Securities Margin Trading only can be completed at branch.

Can I have more information on the mechanism of margin call or liquidation or calculation of financing interest of Securities Margin Trading?

Yes. You can click here and refer to the Securities Margin Trading Factsheet of the Bank.

| Top |

RMB Denominated Stock Trading

Should I use my existing securities account to trade RMB denominated stock? Is it required to set up a new settlement account for RMB stock trading?

Yes, you may use your existing securities account to trade RMB, but a RMB saving or current account has to be set up as the settlement account first.

| Top |

Are the stamp duty, transaction fees for trading RMB denominated stock in RMB or HKD?

The stamp duties and transaction fees (including but not limited to Trading Fee, Transaction Levy) are in HKD, and if the stock is denominated in RMB, the exchange rate provided by HKEx will be applied for the conversion and will be deducted from RMB settlement account.

Can I trade RMB denominated stock with my margin trading account?

No.

| Top |

Closing Auction Session

Which types of securities are eligible for Closing Auction Session (CAS)?

| i) | Major index constituent |

| - | Constituent stocks of Hang Seng Composite LargeCap and MidCap indexes H shares which have corresponding A shares listed on Mainland securities exchanges |

| - | H shares which have corresponding A shares listed on Mainland securities exchanges |

| ii) | All ETFS |

| iii) | Constituent stocks of Hang Seng Composite SmallCap index |

| Top |

What is the trading hours for CAS?

| Full Day Trading | Half Day Trading | |

| Reference Price Fixing Period | 16:00 – 16:01 | 12:00 – 12:01 |

| Order Input Period | 16:01 – 16:06 | 12:01 – 12:06 |

| No Cancellation Period | 16:06 – 16:08 | 12:06 – 12:08 |

| Random Closing Period | 16:08 – 16:10 | 12:08 – 12:10 |

Typhoon arrangement:

If Typhoon Signal No. 8 or above is hoisted before 15:45 (for full day trading) or 11:45 (for half day trading), trading will terminate 15 minutes after the hoisting of the Signal. There will be no CAS for that trading day if trading has not been resumed by 15:45 (for full day trading) or 11:45 (for half day trading).

If Typhoon Signal No. 8 or above is hoisted at or after 15:45 (for full day trading) or 11:45 (for half day trading), trading for the day will continue as normal until the end of the CAS.

| Top |

How does CAS works?

| 16:00 – 16:01 | 16:01 – 16:06 | 16:06 – 16:08 | 16:08 – 16:10 | ||||||

| Reference Price Fixing Period (1 min) | Order Input Period (5 mins) | No-Cancellation Period (2 mins) | Random Closing Period (2 mins) | ||||||

| Price limit allowed: | ||||||||

| +/- 5% of reference price | Within lowest ask & highest bid | ||||||||

| Order type allowed in CCBA: | |||||||||

| At-auction Limit order (ALO) | |||||||||

| Order input, Cancellation & Amendment | |||||||||

| Allowed input, cancel and amend | Input allowed, cancel and amend not allowed | ||||||||

|

|||||||||

- Reference Price Fixing Period: The reference price is determined by HKEx by taking the median of 5 nominal prices in the last minute of the CTS. During this period, the reference price is not available. You can input your ALO through CCBA system but it will be stored in the Bank’s system and passed to the market during the Order Input Period.

- Order Input Period: Only At-auction Limit Order (ALO) within the +/-5% of the reference price can be input. The ALO which is input during the Reference Price Fixing Period will be delivered to market. However, the order may be rejected by market if the price is out of the allowable price limit (within the +/-5% of the reference price). Please be reminded to check the order status in “Order Status / Order History” section of Online Banking or Mobile Banking after order input. Outstanding orders can also be amended or cancelled during this period.

- No Cancellation Period: Only ALO with the price between the lowest ask and highest bid recorded at the end of Order Input Period can be input, and no orders can be amended or cancelled.

- Random Closing Period: Market closes randomly within the last 2 minutes of CAS. After the period, there’s order matching for all CAS securities.

(To know more about the CAS, you may also refer to HKEx website

| Top |

How does the order matching mechanism works?

After the end of Random Closing Period, orders are matched according to order type (at-auction order with higher priority than at-auction limit order), price and time priority at the final Indicative Equilibrium Price (IEP) (i.e. Closing Price).

If final IEF cannot be determined at the end of the CAS, reference price will become the final IEP. In this case, at-auction orders and at-auction limit orders with price at or better than the reference price will be matched at the reference price.

If both IEP and reference price cannot be determined, then there will be no automatic order matching.

| Top |

How the outstanding orders in CTS will be handled?

For orders with the order status 'queued' in "Order Status / Order History" section of our Online Banking or Mobile Banking and the order price falls within the allowable price limit ( +/-5% from reference price) , the orders will be automatically carried forward to CAS .

For the order with the order status 'queued' in "Order Status / Order History" section of our Online Banking or Mobile Banking whereas the order price falls outside the allowable price limit (+/-5% from reference price), the order will not be carried forward to CAS automatically unless the order price is modified and falls within allowable price limit by customer during Order Input Period (16:01 – 16:06) of CAS.

| Top |

How the unfilled / partially filled orders will be handled after CAS?

For Day order: Order of CAS Securities which have not been filled / partially filled will lapse after CAS close.

For Good-till-date (GTD) order: Order of CAS Securities which is unfilled / partially filled during CAS will be automatically carried forward to the next trading day until it is triggered or cancelled or expired.

| Top |

Volatility Control Mechanism

Which types of securities / derivatives are covered by the Volatility Control Mechanism (VCM)?

The scope of securities/derivatives in VCM covers Hang Seng Index (HSI) and Hang Seng China Enterprise Index (HSCEI) constituent stocks and the related index futures contracts.

| Top |

Which trading session(s) that VCM will be triggered?

VCM is applicable during Continuous Trading Session (CTS) except the first 15 minutes of the morning and afternoon CTS and the last 15 minutes of the afternoon CTS. VCM will only last for 5 minutes and it will be triggered 1 time in each trading session for each stock / derivative and no VCM monitoring for the relevant stock / derivative within the same CTS. If morning session of CTS closes before the end of cooling off period, the remaining time of the cooling off period will not be brought forward to afternoon session of CTS.

For market open is delayed due to typhoon signal No. 8 or above is hoisted or black rainstorm, first 15 minutes after market open will still not subject to VCM.

For early market close due to typhoon signal No. 8 or above is hoisted during the trading hour, VCM can still be triggered in the last 15 minutes before market close and continue until market close.

| Top |

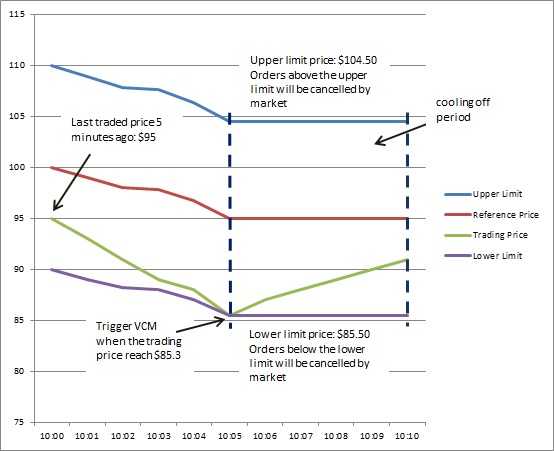

How does the VCM work?

If the market tries to trade VCM’s stocks at a price of more than 10% away from its last traded price 5 minutes ago (“Reference Price”), VCM is triggered (last for 5 minutes). During this cooling-off period, the affected stock will be only allowed to trade within a fixed band of +/- 10% from the Reference Price and only those orders with input price within the fixed band will be accepted.

When VCM is triggered, the orders which trigger the VCM and the outstanding orders which are queued in the market for matching (the order status of such order is ‘queued’ in the Bank) and the price is set outside the fixed band will be rejected by the market immediately. A SMS notification for rejection will be sent to customers’ mobile if the order is placed via our automated trading platform (e.g. Online Banking or Mobile Banking). Customer can also enquire the order status at “Order Status / Order History” section of Online Banking or Mobile Banking or via our Securities Trading Hotline.

(To know more about the VCM, please refer to the website of HKEx http://www.hkex.com.hk/vcm/en/index.htm)

| Top |

How the reference price of VCM being determined?

The reference price should be the last price executed 5 minutes ago. If there is no trade execution 5 minutes before, system will further search backward for the latest last traded price as reference price. This search can go backward till market open where the auction price established during the Pre-opening Session will be used as reference price.

If there is no trade execution from market open to 5 minutes before the start of VCM monitoring, system will use the first traded price as the reference price until there is subsequent execution.

| Top |

Note:

The information contained in these FAQs are for your information only. They are not intended to constitute legal or other professional advice, and you should not rely on any information in this document as an investment advice. CCB(Asia) assumes no responsibility for any errors, omissions or statements within these FAQs, or for any loss or damage (direct or indirect) which may arise from the use of or reliance on any information contained in these FAQs.

© 2018 China Construction Bank (Asia) Corporation Limited. All rights reserved.